Everyone bought mutual funds and other financial products. But investors want to know how their money is doing. Using a percentage calculation, how much money do they make?

For calculations, I use software and an excel spreadsheet. After doing some study, I created or modified numerous excel calculators for investment planning.

Benefit of Mutual Fund Calculator

- The mutual fund investment calculator can provide you with a precise picture of your investments.

- The Mutual Fund calculator allows you to compare mutual funds within the same class or another.

- You can use the Mutual Fund calculator to check returns whenever you want because it is always available.

- You cannot get a clear image of your investment with an online calculator. There are numerous limitations.

How to Calculate Mutual Fund Portfolio Returns?

You all want to invest in mutual funds that offer expected returns, whether you are doing so through a lump sum, a systematic investment plan, or a combination of the two.

However, have you ever considered how mutual fund returns are determined? Does the calculation change when making lump sum investments versus regular investments?

You can examine the many approaches to calculating mutual fund returns.

Absolute or Point to Point Returns

Absolute return is the profit that an asset generates over a given time frame.

This metric examines an asset’s percentage-based appreciation or depreciation over a specific time period, such as that generated by a stock or mutual fund.

Only profits or losses on the investment are taken into account since absolute returns are assessed separately from any other performance indicators.

Let’s use the example of a 35,000 mutual fund investment by an investor. The property’s redemption value has increased to 50,000 two years later. Using the following formula to calculate returns:

Another illustration: Let’s say you put Rs. 50,000 in a fund four years ago. If the current value of your investments is Rs. 85,000, you generated a profit of Rs. 35,000, which equates to an absolute return on your initial investment of Rs. 50,000 of 70%.

The disadvantage of an absolute return is that it ignores time. A return of 70% seems reasonable in the scenario above.

But does it still appear appealing if it was accomplished over five years?

However, the average annual return over the course of four years (CAGR) is 14.18%.

Returns from investments that are less than a year old are computed using the absolute return method.

In all other scenarios, annualized return (CAGR), which calculates the average yearly return on an investment over a specified time period, is utilized.

Mutual Fund SIP Return Calculator

Most of us don’t know how to calculate SIP return in a easy way. If you are invest Lumsum then easy to calculate returns.

SIP Returns Calculation Formula

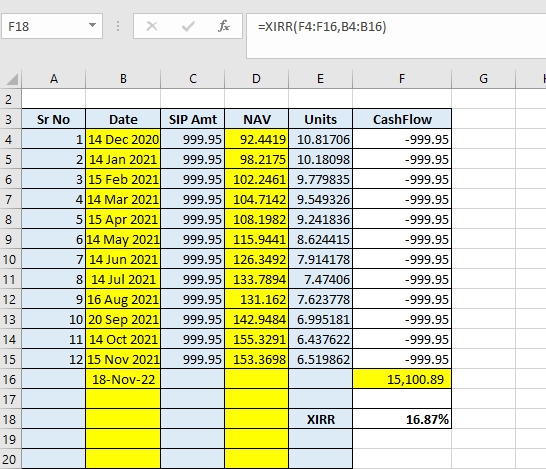

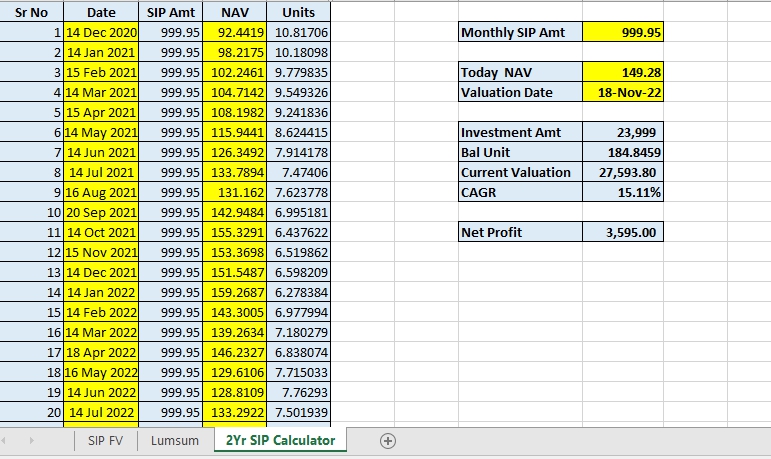

=XIRR(Value,date)

Just fill up SIP date , NAV, Unit and Current date NAV then you find out what is your investment Annual Rate of Return.

3 Comments

Need to understand excel based calculations

Dear friend,

I need Investment /traditional policy,Unit linked policy excel calculator

Vimalkumar : Can you explain basic idea for making ULIP Calulator. Currently I am not tracking any ULIP Schemes/Plan.