Foreign institutional investors play a very important role in the Indian economy. These large players’ purchases of securities cause markets to rise, and vice versa. FIIs are a major contributor to Indian stock market volatility.

What does FII mean?

Foreign institutional investors (FIIs) are institutional investors who invest in assets from countries other than their own.

Foreign institutional investors are the large corporations, such as investment banks and mutual funds, that make significant investments in the Indian markets.

FII’s Role in the Indian Stock Market History

Historically, Foreign Institutional Investors (FIIs) have played an important role in Indian markets. Their movements have frequently had a significant impact on market direction.

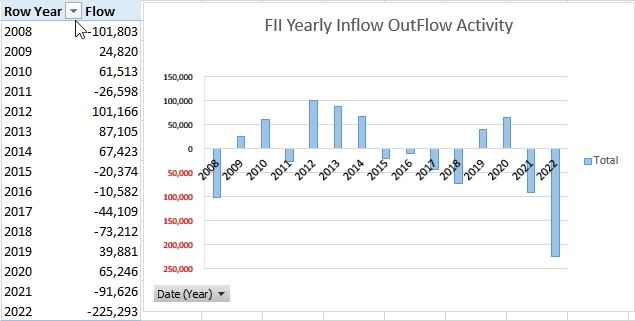

FIIs have demonstrated varying magnitudes and shifting trends over the years. From 2000 to 2003, FII flows experienced a tepid trend, coinciding with the Dotcom bubble.

FIIs poured US $46.4 billion into Indian markets during the “Bull Run” from 2004 to 2007.

However, in 2008, the entire world felt the heat of the global financial crisis, which began in the United States.

By the end of 2008, the Sensex had fallen from around 20465 to 9716. FIIs contributed 101,803 crores in outflows this fall.

We had an excellent period of foreign investor participation from 2009 to 2015.

FIIs invested 86,300 crore in Indian equities in 2009-10. As a result of this inflow, the Sensex 9,600 in January 2009 and reached 20,500 in December 2010.

The period of low FII participation from 2015 to 2018 corresponded with the US central bank’s goal of normalizing monetary policy.

FIIs outflow 148,300 crore in Indian equities in 2015-18. As a result of this outflow, the Sensex 29,000 in January 20015 and reached 36,000 in December 2018.

In January 2019, FIIs appear to have returned to India. Between January 2019 and March 2021, they invested nearly Rs. 157,000 crore in the Indian market.

As a result of this inflow, the Sensex 36,200 in January 2019 and reached 49,500 in March 2021.

The recent outbreak of COVID-19, which resulted in a pandemic and worldwide lockdown, caused a massive market crash in the global and Indian markets.

The Sensex fell from 42,273 to 28,288 within a week of March 2020. FIIs contribute 65,816 crore to this month’s sell-off.

The relentless selling continued in February, March, and April, with FIIs withdrawing Rs 83,709 crore, the worst sell-off in Indian market history.

FIIs pumped in a net of Rs 2.06 lakh crore between May 2020 and March 2021, lifting the Sensex from 33,700 to over 50,000 in March.

Since April 2021, FIIs have been net sellers for 14 months, offloading more than Rs 3.69 lakh crore.

How are American publications reporting on the Asian market?

Bonds and the dollar, which recently touched a nearly two-decade high against major currencies, have gained investors’ attention as they have been forced to flee stocks and riskier Asian assets due to growing fears of a worldwide recession.

“In comparison to the U.S. Fed, rate increases (in Asia) will eventually be less in magnitude and more slowly occurring. Policy rate differences will therefore continue to move against Asia “Rates Strategist at DBS Bank Duncan Tan said.

Reference: