Manage and streamline operations across multiple locations, sales channels, and employees to has improve efficiency and your bottom line.

- Pune

- 7719917444

- rajendra@puneinvest.com

- https://puneinvest.com

From Ancient Currency to Modern Asset

With a monetary heritage spanning 6,000 years—from its first use as currency in 700 B.C. through the classic silver standards of Greek, Roman, and British empires—silver has proven its enduring worth as a store of value. Its historical lineage, however, now meets a modern reality.

In today's markets, silver functions as a strategic hybrid asset. Its price reflects a dual driver: the traditional safe-haven demand it shares with gold, coupled with growing, irreplaceable demand from pivotal industries, offering investors a compelling and multifaceted opportunity.

Precious Metal Side (The "Safe Haven" Driver)

Think of silver as financial insurance. Its core appeal here is protection. When confidence in the economy or paper currency drops, money flows into precious metals.

This "safe-haven" demand helps support silver's price during tough times, making it a proven tool for balancing risk in your portfolio and preserving your savings.

Industrial Metal Side (The "Growth" Driver)

This is where silver truly shines. Over 50% of annual silver demand comes from industrial applications. It's an irreplaceable component in our tech-driven future:

⚡ 5G & Connectivity: Essential for RF antennas and semiconductor packaging in new telecom infrastructure.

💻 Essential Electronics: World’s best conductor. Used in all circuit boards, smartphones, and sensors.

🔋 Green Tech Backbone: Critical for Electric Vehicle (EV) components and energy-efficient appliances.

☀️ Powers Solar Panels: Key material in photovoltaic cells that convert sunlight to electricity efficiently.

⚗️ Industrial Catalyst: Speeds up chemical production for plastics, textiles, and green industrial materials.

💧 Purifies Water: Silver nanoparticles kill bacteria, providing clean drinking water in sustainable systems.

🩹 Fights Germs Naturally: Built-in antimicrobial properties used in medical devices, wound dressings, and hygienic coatings.

This dual nature makes silver a fascinating asset. When the economy booms, industry soaks up supply. When the economy stutters, investment demand can provide a floor.

Gold Silver Ratio -

What it is:

The gold-silver ratio shows how many ounces of silver it takes to buy 1 ounce of gold at current US dollar prices.

Example with $ prices:

Gold price = $4,800 per ounce

Silver price = $80 per ounce

Ratio = 4,800 ÷ 80 ≈ 60:1

This means you need 86 ounces of silver to buy 1 ounce of gold.

What the number tells you:

Ratio is high (e.g., 85+): Silver is relatively cheap compared to gold.

Ratio is low (e.g., below 60): Silver is relatively expensive compared to gold.

Historical average: Around 60:1.

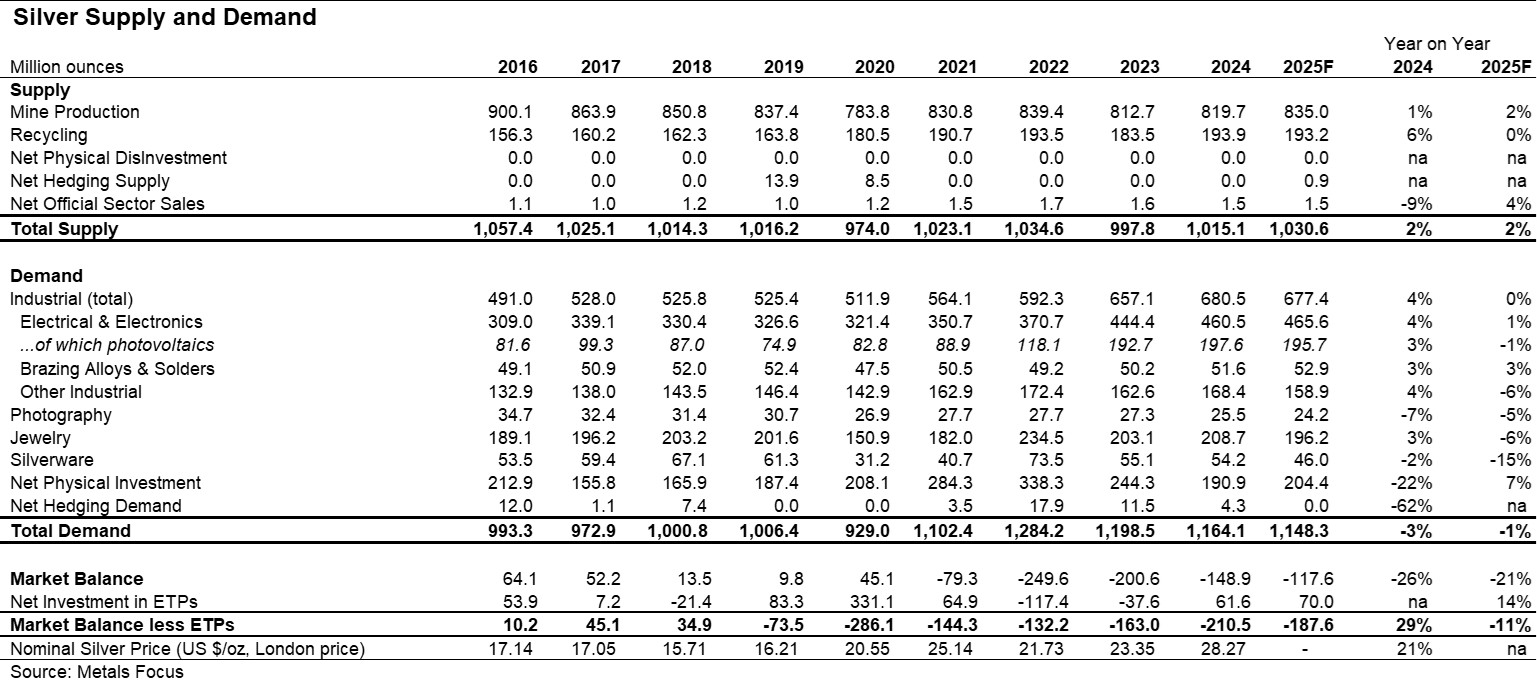

Structural Supply-Demand Deficit

Mine supply constraints.

Soaring industrial demand (green tech push).

How Can You Invest in Silver in India?

Gone are the days of needing a vault. Indian investors have multiple, accessible routes:

Physical Silver: Buying jewellery, coins, or bars. While emotionally satisfying, it involves making charges (for jewellery), secure storage, and purity concerns (hallmarking is key).

Silver ETFs (Exchange-Traded Funds): This is one of the most popular and liquid methods. Each unit of a Silver ETF represents physical silver held securely in a vault. It trades on the stock exchange like a share. Examples include Tata Silver ETF, Aditya Birla Sun Life Silver ETF, etc.

Digital Silver: Platforms like MMTC-PAMP allow you to buy fractional grams of digital silver, which is backed by physical metal, with the option to convert it to delivery.

Should You Invest?

Silver is not a "set and forget" core holding. It's a strategic satellite asset.

Consider it if: You believe in the long-term green energy story, want a hedge against inflation and currency risk, and are comfortable with higher volatility for potentially higher returns.

How to invest: For most, Silver ETFs or Silver Fund offer the perfect blend of convenience, safety, and liquidity. A small allocation (say, 5-10% of your precious metals exposure) can add valuable diversification and growth potential to a balanced portfolio.

Macroeconomic Tailwinds

Persistent Inflation & Currency Devaluation

Global Green Energy & Electrification Push

Geopolitical Uncertainty & Safe-Haven Flows

| Scheme NAV Name | Scheme Code | ISIN | Net Asset Value |

|---|---|---|---|

| 360 ONE Silver ETF | 153415 | INF579M01BC3 | 307.1547 |

| Aditya Birla Sun Life Silver ETF | 149779 | INF209KB19F6 | 312.4986 |

| Axis Silver ETF | 150610 | INF846K011K1 | 310.9862 |

| Bandhan Silver ETF | 153929 | INF194KB1KI9 | 312.4204 |

| DSP Silver ETF | 150523 | INF740KA1RE3 | 302.1809 |

| Edelweiss Silver ETF | 152212 | INF754K01SF3 | 312.6017 |

| Groww Silver ETF | 153524 | INF666M01LA1 | 306.9254 |

| HDFC Silver ETF - Growth Option | 150556 | INF179KC1DI2 | 300.1988 |

| ICICI PRUDENTIAL SILVER ETF | 149464 | INF109KC1Y56 | 312.9648 |

| Kotak Silver ETF | 150948 | INF174KA1KU9 | 304.0226 |

| Mirae Asset Silver ETF | 151779 | INF769K01KG6 | 304.7344 |

| Motilal Oswal Silver ETF | 153820 | INF247L01FZ1 | 308.9459 |

| Nippon India Silver ETF | 149758 | INF204KC1402 | 299.7543 |

| SBI Silver ETF | 152725 | INF200KB1217 | 306.4399 |

| Tata Silver Exchange Traded Fund | 152285 | INF277KA1984 | 31.8485 |

| UTI Silver Exchange Traded Fund | 151730 | INF789F1AYK6 | 299.6332 |

| Zerodha Silver ETF | 153413 | INF0R8F01091 | 31.8937 |

Final Word

Silver is the metal of contradictions—ancient yet futuristic, a safe haven and an industrial powerhouse. Investing in it requires an understanding of both its glittering history and its critical role in building a sustainable future. In the evolving world of commodities, silver's story is just getting a new polish.