Axita Cotton Limited was established in 2013, marking the inception of its commercial operations in 2014. Subsequently, in 2015, the company introduced the Organic Cotton Segment, achieving noteworthy revenue milestones thereafter.

The company’s expansive scope encompasses diverse business verticals, featuring a wide-ranging product portfolio, specialty cotton ventures, and a robust presence in both global and domestic markets.

Moreover, its manufacturing facilities and certifications underscore its commitment to excellence.

Operating across multiple sectors, Axita Cotton Limited engages in the manufacturing and trading of cotton bales, cotton seeds, kapas, and cotton yarn. Spearheading the management team are Mr. Kushal Patel as the Managing Director and Mr. Harsh Shah as the Chief Financial Officer.

The company’s overarching vision is to ensure customer satisfaction through the utilization of premium resources and state-of-the-art systems. Its mission prioritizes employee welfare and endeavors to enhance customer satisfaction by ensuring prompt deliveries and elevating product quality standards.

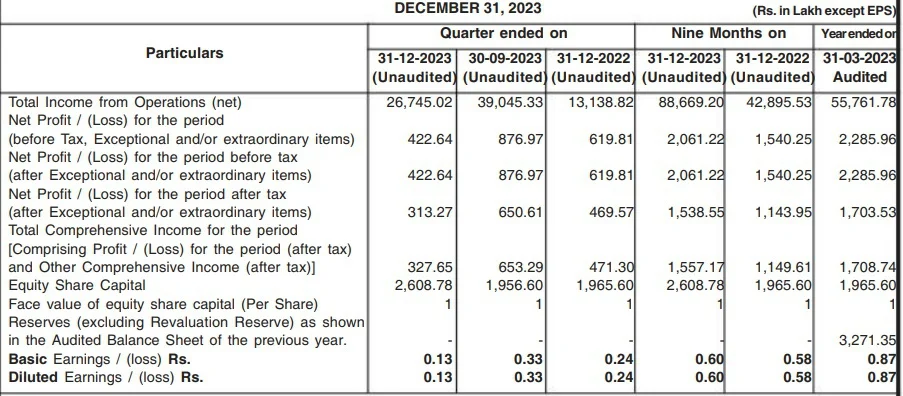

Demonstrating consistent revenue growth, the company has expanded its footprint in both domestic and international markets. Its debt-free status, coupled with unwavering adherence to its mission and vision, underscores a steadfast commitment to quality and customer satisfaction.

Moreover, Axita Cotton Limited’s significance within India’s textile industry, the second-largest globally, is highlighted, emphasizing its substantial contributions to the nation’s GDP, industrial output, and exports.

A retrospective glance at corporate actions reveals significant developments, including a stock split from ₹10 to ₹1 in October 2022, along with bonus issues in January 2022 and December 2019.

Examining the shareholding pattern, as of 2022, reveals a distribution with the Promoter & Promoter Group holding 18.72%, Foreign Portfolio Investors (FPI) owning 11.63%, and retail investors comprising the majority with 69.65%.

Transitioning to 2024, a notable transformation emerges, with the Promoter & Promoter Group’s stake skyrocketing to an impressive 69.97%, while retail investors’ share diminishes to 30.03%. This remarkable surge in promoter holding signals heightened confidence in the company’s future prospects.

Financially, a higher promoter holding is often interpreted positively, reflecting a strong belief in the company’s growth trajectory. This substantial increase suggests a deepened alignment between the promoters and the company’s success, indicative of a phase of robust growth ahead.

Moreover, technical analysis indicates an opportune moment for investment, with the current stock price of 27 presenting a promising entry point. Recommended short-term stop-loss and targets further reinforce the potential for favorable returns.