Are you invested in a mutual fund? If so, one important task you should consider is updating and checking the nomination details in all your invested folios. This process is quite straightforward and can be easily done.

Investing in mutual funds can be a smart way to grow your wealth over time, but it's important to understand the process of nominating a person to receive your assets in the event of your death or incapacity.

If you need assistance with the mutual fund nomination process, including access to forms and recent updates, you've come to the right place. Feel free to ask any questions or seek guidance regarding this topic.

What is a Mutual Fund Nomination?

Mutual Fund nomination means choosing someone to take care of your investments in the fund after you pass away.

The nominee's nomination guarantees that, after your death, your Mutual Fund holdings will be transferred to the nominee.

Both individual and joint unitholders have the opportunity to make nominations.

New norms for Mutual Fund nomination?

According to the Securities and Exchange Board of India (SEBI), Unit holders of mutual fund would have the choice to submit a nomination or to opt-out by submitting a declaration form that has been duly signed.

For all current individual unitholders who hold mutual fund units either individual or jointly, all asset management companies have been advised to set the deadline for this as Sep 30, 2023, failing which the folios shall be frozen for debits, SEBI said in a circular.

Who can be a nominee?

A nominee could be a family member such as the spouse of your child or partner or an NRI or even a close friend or acquaintance.

If the nominee is a minor, the name and email address of the person who is the guardian for the minor nominee must be provided by the person making the nomination.

Who Cannot Nominate?

The Nominee should not be constitute the trustee of a trust (expect for charitable or religious trust) or society, body/corporation, partnership firm, Hindu Undivided Family (HUF) or any other.

Minors, typically individuals below the age of 18, may not be allowed to nominate in mutual funds without the involvement of a guardian or parent.

Why is it necessary to make a Nomination?

Making a nomination in a mutual fund is necessary for the following reasons:

- Clarity of Beneficiary: By nominating someone in a mutual fund, you ensure that there is a clear beneficiary who will receive the proceeds of your investment in case of your demise. This eliminates ambiguity and helps ensure that your intended recipient receives the investment proceeds.

- Smooth Asset Transfer: A valid nomination facilitates the smooth and efficient transfer of your mutual fund units to the nominee. It simplifies the process for the nominee to claim the investment and reduces the administrative and legal formalities involved.

- Easy Claim Settle: In the event of a claim, it typically takes 10-15 days to transfer the funds to the nominee's name, provided all the necessary documents are in order.

- Avoidance of Disputes: Nomination helps prevent potential conflicts or disputes among family members or other heirs. By specifying the nominee, you establish a legal framework for the transfer of your mutual fund units, reducing the likelihood of disagreements and ensuring that your chosen beneficiary receives the investment proceeds.

- Expedited Settlement: In the absence of a valid nomination, the settlement of your mutual fund units can be delayed and require additional documentation and legal procedures. A nomination expedites the settlement process, allowing for a faster transfer of the investment proceeds to the nominee.

- Flexibility and Revocability: Making a nomination in a mutual fund provides flexibility as it can be modified or revoked during your lifetime. This allows you to update the nominee details as per your changing circumstances or preferences.

Cancellation of Nomination

A nomination of the Units will not grant an ownership interest on the property until dies the Unitholders.

The Unit's rights are transferred to the nominee(s) only on the passing of each Unit Holder.

It should be noted that a nominee will not necessarily be granted rights or beneficial interests in the property because of that nomination.

The nominee(s) are entitled to the Units as trustees and agents of the legal heirs and legatees, as the case may be.

The cancellation of nominations can be done only by persons who hold units on themselves, individually or jointly, and have submitted the initial nomination.

A new nomination request could cause the cancellation of previous nominations and replacement of it with a fresh nomination, i.e., a new nomination for folio will be automatically overwritten by an existing nomination.

How to nominate?

Nominations can be submitted during the Initial Application to purchase units or later.

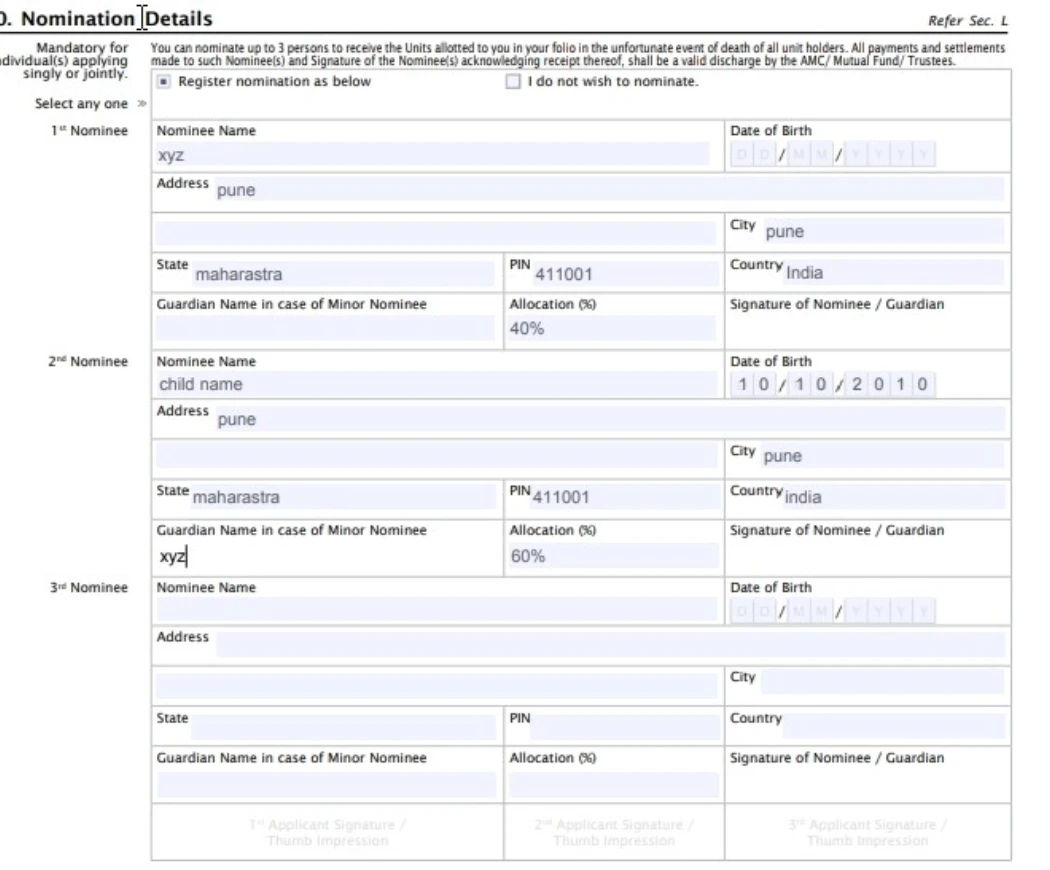

If you want to make a nomination when investing in a mutual fund for the first time, the investor must fill in the section ‘Nomination Details' in the Application Form.

Sample Format of Mutual Fund Nomination

- Once a nomination is made, it can be modified or changed multiple times at any point in time.

- You can nominate up to three persons.

- Investor must specify the percentage of allocation in favour of each nominee against their names, and the allocation must be presented in a single number with no decimals.

- If the proportion of allocation/share for each nominee is not stated in the nomination, the AMC will be able to resolve the claim equally across all nominated.

- The Nomination Form needs to be completed by the unitholder (with the handwritten signature).

- If the units are owned jointly, all joint holder will have to fill out the nomination form regardless of how the accounts are operated.

- The signature of all holders is required.

Download the Standard MF Nomination Form use for all mutual fund.

For UNITS held in ELECTRONIC (DEMAT) MODE:

In the case of mutual fund units electronically (Demat) mode, the nominee information provided to the Unitholder to the Depository will be applied to mutual fund units within the Demat format.

Any nomination, including any modification or cancellation of Nominee(s), is controlled by regulations and Byelaws governing the Depository.

The transfer of the money to the nominee of a Demat account will relieve the Mutual Fund of all liability to any estates of deceased Unitholders and their legal heirs or legal successors.

Suppose a Demat account has joint holders in the event of the death of one member of the joint holder(s).

In that case, those securities are transferred to the survivor holder(s), only in the case that all joint holders, the Units or securities will be sent directly to the nominated person.

What happens if you do not have a nominee?

Sometimes, we delay updating the nominee. In other instances, the nominee might die suddenly, and you'll be left wondering what to do about Mutual Fund units after the investor's death.

In this case, the legal heirs can claim your mutual fund.

Major Point to remember:

- The nomination is only made by those applying for/holding units on their behalf in a single or joint application.

- The nomination is not permitted in a folio belonging to a Minor unitholder.

- If units are jointly held, all joint owners have to submit the nomination form.

- Minors can be nominated. In this case, names and addresses of the Guardian of the minor nominee are required.

- The nomination can also be made in favor of any of the following: Central Government, State Government or local authorities, anyone designated as a result of their office, or in the case of a charitable or religious trust.

- A non-resident Indian can be appointed following the applicable exchange control regulations.

- Multiple nominees: The nomination can be submitted in support of multiple nominees.

- If there is one, each new nomination for an account/folio should be overwritten by the current nomination.

- Any nomination made by an owner of a unit is valid for units within all the schemes of the folio/account of the unit.

- The nomination of units is cancelled upon unit redemption.

- Death of Nominee/s: If the nominee(s) before the death of the unitholder(s) and the unitholder are advised to submit another nomination as soon as possible following the death of the nominee. The nomination will be automatically removed if the nominee(s) before their unitholder(s) death.

- In the event of multiple nominations, if one of the nominees dies at the time of the death claim settlement, that nominee's share of the settlement will be distributed equally among the nominees who survived.

- Unitholders who don't want to nominate must confirm this by writing their choice in the box on form.

- The nomination will be recorded only after the form is complete in all respects following the AMC.

- Cancellation of nomination: A request for cancellation of Nominations made may be made by only the unitholders. Nominations will be cancelled in the event of cancellation, and the AMC is not obligated to transfer or transmit units to the nominee.

- The Nominee is not the trust (other than charitable or religious) such as a body corporate, society or partnership firm, Karta of the Hindu Undivided Family or the Power of Attorney holder.

Online Nomination for KFin Tech Registrar

Investors can Click here to update the details ONLINE now on the KFIN MFS website!

List of Mutual Fund Company Serve By KFIN Tech- Karvy:

Axis Mutual Fund, Baroda BNP Paribas Asset Management Ind Pvt Ltd, Bank of India Investment Managers Pvt. Ltd, Canara Robeco Mutual Fund, Edelweiss Mutual Fund, Navi Asset Management Ltd, IDBI Mutual Fund, Indiabulls Mutual Fund, Invesco Mutual Fund, ITI Mutual Fund, JM Mutual Fund, LIC Mutual Fund, Mirae Asset Mutual Fund, Motilal Oswal Mutual Fund, Nippon India Mutual Fund, NJ Asset Management Pvt. Ltd, PGIM India Mutual Fund, Principal Mutual Fund, Quant Mutual Fund, Quantum Mutual Fund, Sahara Mutual Fund, Samco Asset Management Pvt. Ltd, Sundaram Mutual Fund, Taurus Mutual Fund, Trust Asset Management Co. Ltd, UTI Mutual Fund

Online facility can be used only by investors with sole /single holding folios where PAN and either Email or mobile is registered in the folio.

List of Mutual Funds serviced by CAMS:

Aditya Birla Sunlife MF, Bandhan MF, DSP MF, Franklin Templeton MF, HDFC MF, L&T Investment Management Ltd. (HSBC MF), ICICI Prudential MF, IIFL MF, Kotak MF, Mahindra Manulife MF, PPFAS MF, SBI MF, Sriram MF, Tata MF, Union MF and WhiteOak Capital MF.

Conclusion

Biggest benefit of a making nominee is that its helps in smooth transfer of the funds to nominees in case of demise of the investor.